Self-Paced Digital Learning

Our self-paced digital courses equip participants with an understanding of key technical and analytic concepts.

We have applied our 25+ years experience in designing effective credit and risk analysis training to create digital learning that is structured, focused on key topics and relevant to the learner.

The digital courses can stand alone as a self-paced study course or form part of a blended learning programme and offer content relevant to those working in relationship management, risk functions or as analysts.

The coursework has given me a better understanding of the subject matter and given me more confidence when assessing entities. It also has prompted a more in-depth analysis that scrutinizes financial data beyond what is purely contained in the key ratios. – Credit Risk Analyst

They have made accessing meaningful and practically useful information in accounts accessible to me as a non-accounting trained professional. – Insurance Underwriter

Digital Learning Topics

Corporate and Commercial Credit

Fundamentals

- Accounting foundations

- Industry risks

- 3Rs – Lending rationales

- Valuations

Financial Statement Analysis

- Business dynamics

- Sales and profitability

- Financial risks

Bank Analysis

Fundamentals

- Bank business models

- Core products

- Key risks

- Introduction to accounting

- Key performance measures

Financial Statement Analysis

- Accounting principles

- Capital adequacy

- Asset quality

- Earnings

- Liquidity

- Sensitivity to market risk

Insurance Analysis

- Business models

- General insurance

- Life insurance

- Reinsurance

- Accounting

- Financial analysis

Funds and Asset Managers

- Funds and asset manager business models

- Accounting for funds

- Funds: risks and regulations

Sovereign and Public Sector

- Public sector business models

- Sovereign analysis

- Development organisation financial strength

Non-Bank Financial Institutions

- Finance and leasing companies

- Brokers and broker dealers

Regulatory Drivers

- Basel III

- Bank capital management

- Liquidity and funding

- IFRS 9

- Resolution

Your Business Explained

A customised eLearning solution

Key drivers of success

- How banks make money

- Economic and competitive drivers

- Financial strength benchmarked to peers

Enterprise-Wide Risk Management

- Risk in context

- Country risk

- Non-financial risk

- Market risk

- Liquidity risk

- Credit and counterparty risk

Product Solutions

Risk profile and business opportunities

- Loans

- Asset finance

- Securities

- Derivatives applications

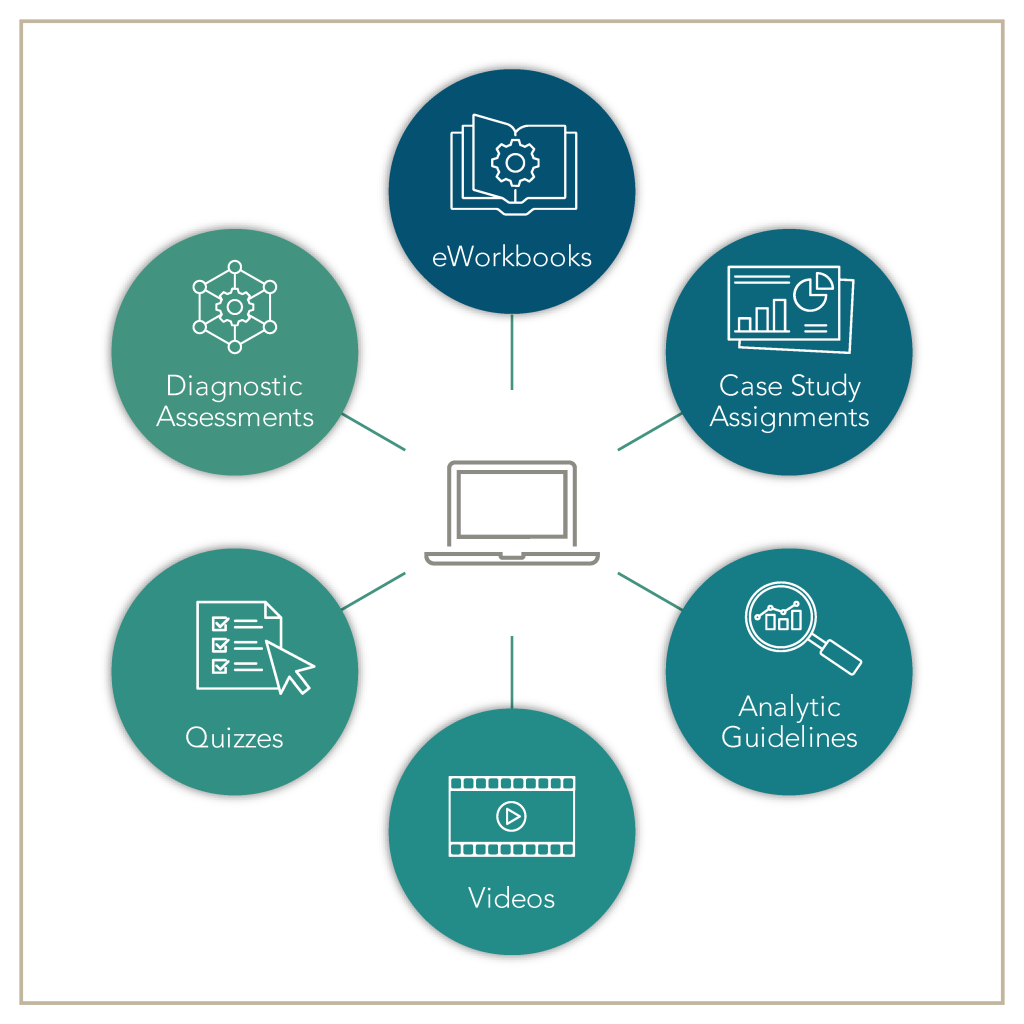

Key Features

Interactive eWorkbooks

The eWorkbooks are interactive modules that form the core of our digital learning experience:

- Concepts are presented in a logical and structured manner.

- Real-life examples demonstrate practical application of concepts.

- Interactive tools provide an engaging and active learning experience.

- Quizzes and exercises reinforce key learning points.

- Valuable resources for future reference.

Assessment Tools

- Diagnostic assessments measure prior knowledge and identify areas where participants need to focus their time. They also allow experienced participants to “test out” by recognising their existing expertise.

- Formative exercises and quizzes are included at regular points in the eWorkbooks, helping participants check and apply what they are learning.

- End-of-module multiple choice assessments evaluate learning and understanding on completion of a module. They can be used for self-assessment or as part of formal certification or grading.

User-friendly LMS

- An intuitive learner dashboard provides easy access to courses and helps learners monitor their progress.

- All content is in one place in structured learning paths.

- Suite of reports to track learner progression, assessment results, survey responses and training histories.

- Our administration team supports users with their queries and provides regular reminders and nudges.