The following article is from our latest FIG in Focus newsletter.

Impaired loans continue to fall at 2018 year-end whilst IFRS 9 expected loss provisioning has a mixed effect.

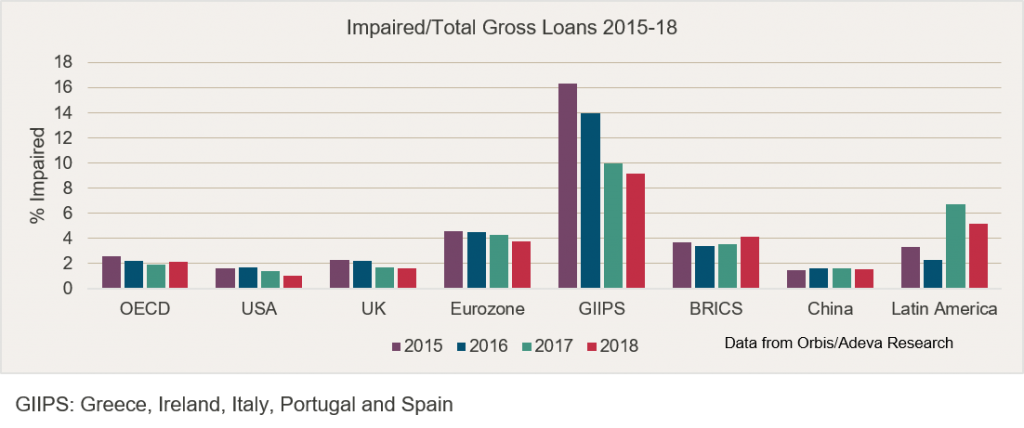

Bank impaired loans in almost all jurisdictions continued to fall in 2018, which considering the clouds on the macro-economic and political horizon may represent a cyclical low. Developed economies in particular, performed especially strongly with USA and Eurozone rates falling by 0.4% and 0.5% respectively. The latter was partially due to significant improvements in the NPL ratios of large Italian banks, which was partially effected through the securitisation of non-performing loans.

For emerging economies there was more of a mixed picture. BRIC’s showed an average increase of 0.6% driven by rising impairments in Russian and South African banks, partially offset by improving performance in Brazil. China showed little change overall, although the performance at an individual bank level is mixed.

The improvement in Brazil was also responsible for a general improvement in Latin America, although the picture across other countries was a little more variable.

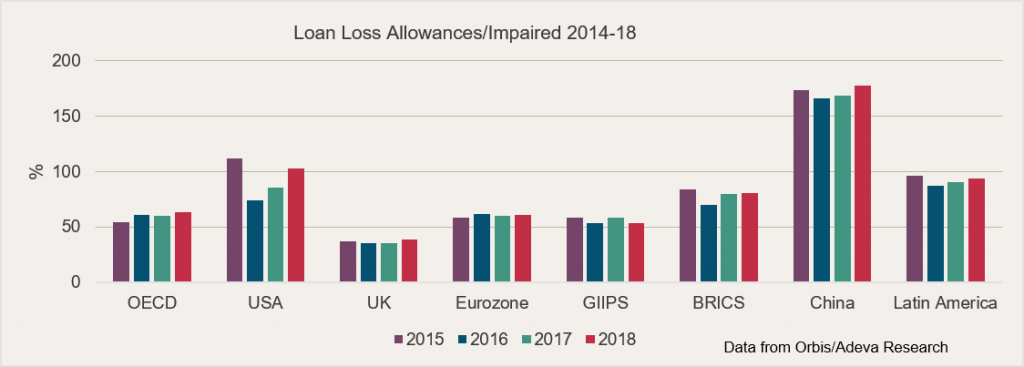

In terms of the allowances made for impaired loans, the adoption of IFRS 9 seems to have had a mixed effect. In general, provisioning for expected loss seems to have slightly increased allowances, particularly in the UK, Eurozone and Latin America. In jurisdictions where provisioning models are highly developed, the increase may be attributed to the inclusion of Stage 2 (increased credit risk but not impaired) allowances. In China, provisioning against often considerable levels of special mention loans has increased allowances from 169% to 177% under IFRS 9.

In peripheral Europe however, IFRS9 adoption appears to have reduced provisions in certain banks. This may be due to banks carrying historically large allowances, which are too great on an expected loss basis due to recovering property values. In Italy NPL securitisations may have also assisted this trend.

In the USA, where IFRS9 has not been adapted, allowances have increased from 85% to 100% of impaired. As IFRS 9 has not been adopted, (USGAAP will adopt its own expected loss model from 2020), this appears to be caused by holding absolute USD allowance levels relatively flat whilst, as previously discussed, impairment levels have fallen by almost a third. However, as expected loss provisioning for US banks is expected to have a significant impact, the retention of existing allowances appears prudent.